SAP Finance standardisation, in essence, is the process of creating standards to establish consistent and uniform financial accounting, reporting, and operational practices.

The goal of this process is all about ensuring your financial information is reliable, transparent, and comparable. This, in turn, can help improve your company’s overall efficiency and decision-making while reducing operational risks.

Finance standardisation may also help facilitate the consolidation of financial information between different entities. Thus, the ability of the organisation to be flexible and react quickly to change.

Importance of Finance Standardisation in SAP

Three critical components of SAP finance standardisation are Processes, Organisation and Systems.

- By standardising finance processes, you can ensure that the financial report you get is timely, reliable and consistent. Therefore, implementing the same into your system can help you reduce errors and inconsistencies in financial data.

- Standardisation of financial organisation and master data is a pre-requisite to making your processes more streamlined, agile and possibly automated via advanced technologies like RPA and Artificial Intelligence. The time and effort needed to complete a task will become much less.

- When teams worldwide operate differently or use various systems and processes to execute similar activities, comparing and evaluating financial data efficiently won’t be easy. As such, standardisation is crucial in eliminating errors or duplications and enabling data-driven business decisions.

In addition to these, standardised financial data can also help to improve transparency or accountability, therefore, making it easier for a stakeholder to understand your company’s financial and productivity level. Making informed decisions will be simpler too.

Besides, finance standardisation can help organisations to ensure compliance with financial reporting frameworks, such as IFRS and GAAP, and adapt quickly to any updates (e.g. sustainability disclosure). This can help to decrease the risk of non-compliance and associated penalties.

In short, finance standardisation brings about several benefits.

cbs ONE Finance and Finance Standardisation – Everything You Need to Know!

In today’s world, it is no longer sufficient for CFOs to manage internal and external financial reporting, ensuring compliance with financial regulations. Many finance leaders must have foresight, analyse risks and quickly adapt to change. Hence, they must increase digitalisation and ensure high process efficiency through globally uniform structures and procedures.

To help organisations with finance standardisation, cbs offers a product called ONE Finance which covers all services from developing a strategy to defining concepts and, finally, realising, using market-leading transformation skills. This paves the direct way to global standardised solutions.

Some elements of standardisation include:

- Organisational units, e.g. Controlling Area, Company code, Plant

- Enterprise master data, e.g. Chart of Accounts, Profit centre, Cost centre

- Controlling parameters, e.g. Document Types, Terms of payment

- Valuation-relevant keys, e.g. Product hierarchy, valuation classes

- Operational master data, e.g. Material, Business Partner (Customer, Vendor)

- Technical keys, e.g. number ranges

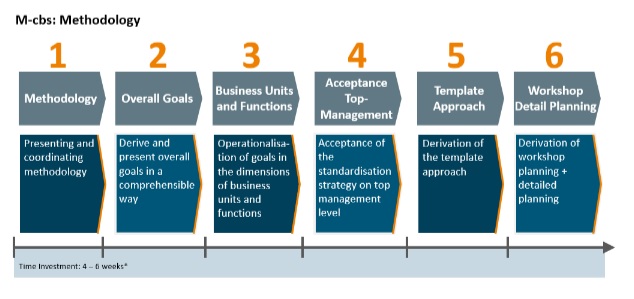

cbs ONE Finance supports organisations with defining a standardisation strategy through six steps:

Step 1 (Methodology) and 2 (Overall Goals) involve adapting business strategy, business unit strategy and merger and acquisition strategy. Acquiring pain points from top management is also included in these initial steps.

Step 3 (Business Units and Functions) then proceeds to create a vision for future standardisation according to functions and process areas, make an inventory of processes, prioritise pain points per process area and consider the level of standardisation.

Step 4 (Acceptance Top-Management) includes presenting the selected standardisation level to top management, representing impacts and obtaining management’s commitment to the initiative and the high-level program plan.

Step 5 (Template Approach) involves deciding if the template only defines framework conditions within the group, covers only 80% of group-wide processes, or includes all processes and only allows changes due to legal requirements.

Step 6 (Workshop Detail Planning) finally works on detailed planning based on the decision of the template approach.

These steps can take some time and commitment to complete. But, if you work with a proper goal, you will undoubtedly succeed.

FAQs – Frequently Asked Questions

In this section, we’ve offered more information about finance standardisation and how it works properly. So, let’s keep reading until the end to get more information.

What are the benefits of finance standardisation?

The standardised structures and processes enable the CEO, CFO and CIO to control the company more actively and precisely. Uniform structures ensure company units are comparable with each other. Harmonised and standardised processes accelerate period-end closing activities. The result is a transparent and efficiently controllable company that can optimally use and implement future innovations.

What are the key features of cbs ONE Finance?

cbs ONE Finance is all about the standardisation and harmonisation of Finance and Controlling business processes, operating models and systems. The key features include best practices in finance and controlling (e.g. industry-specific processes, IFRS compliant Chart of Accounts), finance target operating model (e.g. centralise, decentralise or shared service center), innovative apps (e.g. management accounting dashboards, analytics reporting) and advanced technologies (e.g. SAP Analytics Cloud, Signavio).

How long does it take to implement cbs ONE Finance?

The implementation of cbs ONE Finance varies depending on the size and complexity of the organisation. Typically, it can take several months to more than a year to complete the implementation.

What are the costs associated with implementing cbs ONE Finance?

The costs associated with implementing cbs ONE Finance can vary depending on the size and complexity of the organisation. It can include software licenses, implementation fees, hardware costs, training costs, and ongoing support and maintenance costs.

Is cbs ONE Finance suitable for small and medium-sized enterprises?

SAP One Finance is designed to meet the needs of organisations of all sizes, including small and medium-sized enterprises.

It also offers a range of features and functionality that can help organisations to standardise their financial processes and improve their financial performance.

The Bottom Line

Before jumping on the bandwagon of business transformation, it is important to set a stable base with standardisation and harmonisation. The final goal to be achieved needs to be clear before embarking on any journey to transformation. Should you like to learn more about SAP finance standardisation, do contact us today.