In a dynamic business environment, new technologies and capabilities are needed to stay ahead. Can finance and IT enable the company to position itself for the future? Can efficient governance and innovation be combined in an agile, end-to-end SAP ERP system in a timely manner?

Finance is one of the main drivers of digital transformation. After all, effective management has always been crucial for corporate success, even more so in times of rising costs and a slowing economy. It is essential to react quickly to external factors and to be able to make well-founded decisions adapted to the current company and market conditions.

This can only be achieved with a global, harmonized and standardized SAP enterprise platform. This platform must be also increasingly flexible and capable of being expanded with novel functionalities. New requirements are constantly arising from the socio-political and economic context. From 2024, for example, a CO2 reporting obligation will apply to companies in the EU. As a result, we see the innovation of the “green ledger” in the finance environment, which records ESG data in accounting terms with the help of finance structures. Rapid decisions in the increasingly complex value chain are also almost exclusively supported by a modern finance department.

Innovation meets Transformation

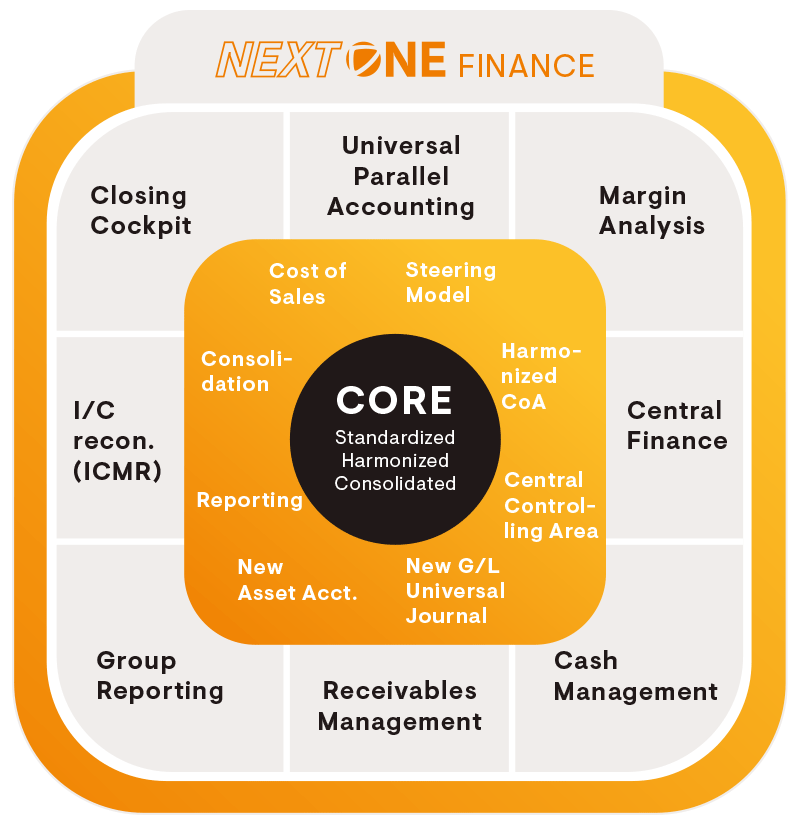

Finance needs to combine efficient governance with innovation in an agile, end-to-end business process platform in a future-oriented way. Our strategy to achieve this is encapsulated in the NEXT ONE Finance approach. At the core of NEXT ONE Finance lies ONE Finance, which standardizes the structures of operative accounting and management accounting. Creating uniform reporting structures and dimensions forms the basis for an agile implementation of innovative NEXT ONE Finance building blocks.

This standardized core ensures future viability to support key innovation drivers. In the NEXT ONE Finance target picture, topics with maximum impact are implemented early. This frontloads the value-add and enables companies to react in a targeted and agile manner to changes in the market that influence the value proposition.

The cbs approach always considers the current position of the company as an input variable to tailor the necessary content of the NEXT ONE Finance portfolio. This helps identify current challenges and implement solutions for them in the short and medium term.

For that, we continuously assess the latest SAP products, gauging their potential advantages, market maturity, long-term viability, and significance for corporate governance. Expert knowledge and experience are paramount here. A significant, value-creating innovation is, for example, Universal Parallel Accounting, which forms the technical basis for mapping additional valuation views and dimensions for the entire supply chain in the finance results. This is used to implement the green ledger, or group valuation, separating the legal requirements from an internal view. Without Universal Parallel Accounting, this would only be possible with additional business functions and only to a limited extent.

Managing Innovation

In the realm of major transformation projects, such as the transition to SAP S/4HANA, the first step is to develop a long-term target picture that maps the strategic and functional requirements of the company. It is important to acknowledge the technical side of things and implementation feasibility, as well as to adopt a holistic outlook. One should not focus on singular facets like, for example, the introduction of a New General Ledger. Rather, at the beginning of the NEXT ONE Finance Journey, the question is how the corporate strategy can be made measurable and how an SAP system should be set up in terms of structures and functionalities to support the implementation of the strategy. From such a management performance system or control model, a target picture can be generated for the ultimate building stage of the system landscape, which outlines the requirements for internal and external accounting, as well as supply chain management.

For the implementation of large transformation projects, an agile procedural model has been established in which the roadmap is divided into realistic steps or phases. When planning these steps, it’s crucial to account for transformational task interdependencies along the timeline and actively manage expectations within the IT team and the business division.

One of our large industrial customers is currently in the first phase of the transition to SAP S/4HANA with a greenfield approach. In the first step, a solid ONE Finance basic structure is being created, leading to a harmonized system and process landscape that includes the entire value chain. Building on this stable structure, the company will implement further innovations in the subsequent phases, such as Group Valuation, Closing Cockpit, Intercompany Reconciliation and Margin Analysis.

It is always important to monitor the organization’s capacities while maintaining rapid progress. Through our many years of experience and our Selective Data Transition approach, we move our clients forward and achieve rapid added value for them. This is imperative, as stagnation could swiftly relegate you to the rear of the innovation cycle while competitors move ahead.

Where do you and your finance division currently stand on the path to digital transformation? Become a pioneer of digitalization and combine innovation and transformation to gain decisive competitive advantages. We are passionate about supporting you in developing the next generation of business solutions and transferring them swiftly into corporate reality. How can we help you? Get in touch with us.

Ihr Kontakt